b&o tax states

Delaware Nevada Ohio Oregon Tennessee Texas and Washington. The rate paid varies according to the type of activity performed by the business and the taxable base is ALL revenue earned by the company.

Zip Code Zones In The Usa Zip Code Map Coding Us Map

For example if you extract or manufacture goods for your own use you owe BO tax.

. Business and Occupation Tax. The nature of the activity determines the appropriate classification and tax rate. All parties that do business in the State of Washington are required to pay Business And Occupation taxes including Tax Exempt Non-Profit Organizations.

Washingtons BO tax is calculated on the gross income from activities. B O tax rates. 253 591-5252 by contacting the Tacoma.

South Carolina charges all three major state tax types but does so in moderation. Dditional credits are available of up to 1000 every year. BO also does not consider income or loss offers no deduction for cost of.

Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level. This means there are no deductions from the BO tax for labor materials taxes or other costs of doing. Constitution because it discriminates against out-of.

The BO offers very few deductions and those allowable are often within narrowly defined industry sectors. This means you pay taxes on the total amount of revenue you pull in for your business whether you make a profit or not. Washington BO Tax Classifications.

The state BO tax is a gross receipts tax. The High Technology BO Tax Credit for qualiied research and development RD expenditures and the High Technology Sales and Use Tax Deferral on construction of eligible facilities and purchases of qualiied machinery and equipment expire on January 1 2015. Washington State BO tax is based on the gross income from business activities.

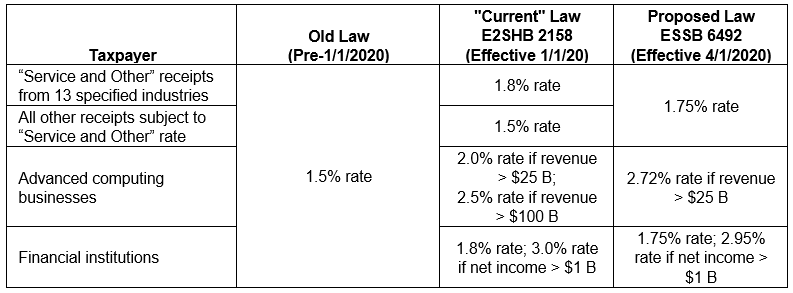

Washington unlike many other states does not have an income tax. Unlike the retail sales tax a sale does not have to occur for a business to owe BO tax. Additional BO tax imposed on financial institutions.

Sales and excise taxes. Most Washington businesses fall under the 15 gross receipts tax rate. Its sales and excise tax burden of 262 clocks in.

Manufacturing BO Tax or Wholesaling or Retailing BO Tax. The Washington State Business and Occupation tax BO tax is measured on a companys gross receipts. A Washington State superior court granted summary judgment for banking associations holding that the states additional 12 business and occupation BO tax imposed on certain financial institutions violates the Commerce Clause of the US.

City of Tacoma Tax License Division 747 Market St Rm 212 Tacoma WA 98402. The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT. This tax increase threatens to negatively impact these practicesand their patients.

There are multiple states with gross receipts tax. Get an extra 250 BO tax credit if the position meets the definition of a. Take the credit against your Tacoma BO taxes each year and attach aJob heet.

However your business may qualify for certain exemptions deductions or credits. When you submitted your gross receipts you received a check for 50000. 32 rows B.

In addition staffing businesses must collect retail sales tax and remit the collected tax to the state on all income subject to the retailing classification of the BO tax unless a specific statutory exemption applies. Business owners should be aware of the gross receipts tax requirements in these states and to take action to prevent liabilities from accumulating over time. However you may be entitled to the.

For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. The tax amount is based on the value of the manufactured products or by-products. Businesses pay a Washington BO tax rate depending on their classification.

This includes the value of products gross proceeds of sale or the gross income of the business. Extracting Extracting for Hire00484. Heres what the BO tax looks like for your business.

It is measured on the value of products gross proceeds of sale or gross income of the business. The BO tax for labor materials taxes or other costs of doing business. Average state tax burden.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. The model was updated in 2007 2012 and 2019EHB 2005 passed in 2017 also established a task force of city and business representatives to recommend changes to the two-factor apportionment formula for service income under RCW. It is taxed at 0 percent on manufacturing gross production.

Get an extra 500 BO tax credit if the employee that fills the new position is a Tacoma resident. Legislation adopted in the 2003 session required the 45 cities with local BO taxes to adopt a city BO tax model ordinance. Those who make or sell products in Washington will face two BO taxes.

A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. When paying the B O tax to the Department of Revenue you declare your income in different categories. This creates a situation where even an unprofitable business is still liable for B.

2020 a 20 increase to Washington states business and occupation BO tax goes into effect increasing the tax burden on health care providers including independent physician practices. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates ranging from 0138 percent to 15 percent.

B Amp O Tax City Of Bellingham

B Amp O Tax Return City Of Bellevue

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

Why Our B O Tax Is Unfair R Seattlewa

1951 Lunch Menu From The Santa Fe Railroad Dining Car The Chief Fred Harvey Vintage Menu Menu Restaurant Vintage Restaurant

A Quick Guide To Washington S Tax Code Economic Opportunity Institute Economic Opportunity Institute

When Are Washington S Business Occupation B O Taxes Due 2021 Youtube

Boeing S Jumbo Milestone The 1 500th 747 Boeing Commercial Aircraft Cargo Aircraft

A Guide To Business And Occupation Tax City Of Bellingham Wa

Are The New B O Beoplay Portal The Ultimate Headphones For Gamers

When Are Business Occupation B O Taxes Due

Are The New B O Beoplay Portal The Ultimate Headphones For Gamers

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

Netherlands Both Urban And Agricultural Number Two Facts Fun Facts

Bang Olufsen Beoplay E8 Wireless Earphones Lux Afrique Boutique

Valley Of The Shadow Amazing Website All About Shenandoah Valley Before During After Civil War Unit Teaching American History High School History Teacher