personal property tax car richmond va

Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. What seems a large increase in value may actually turn into a tiny increase in your property tax bill.

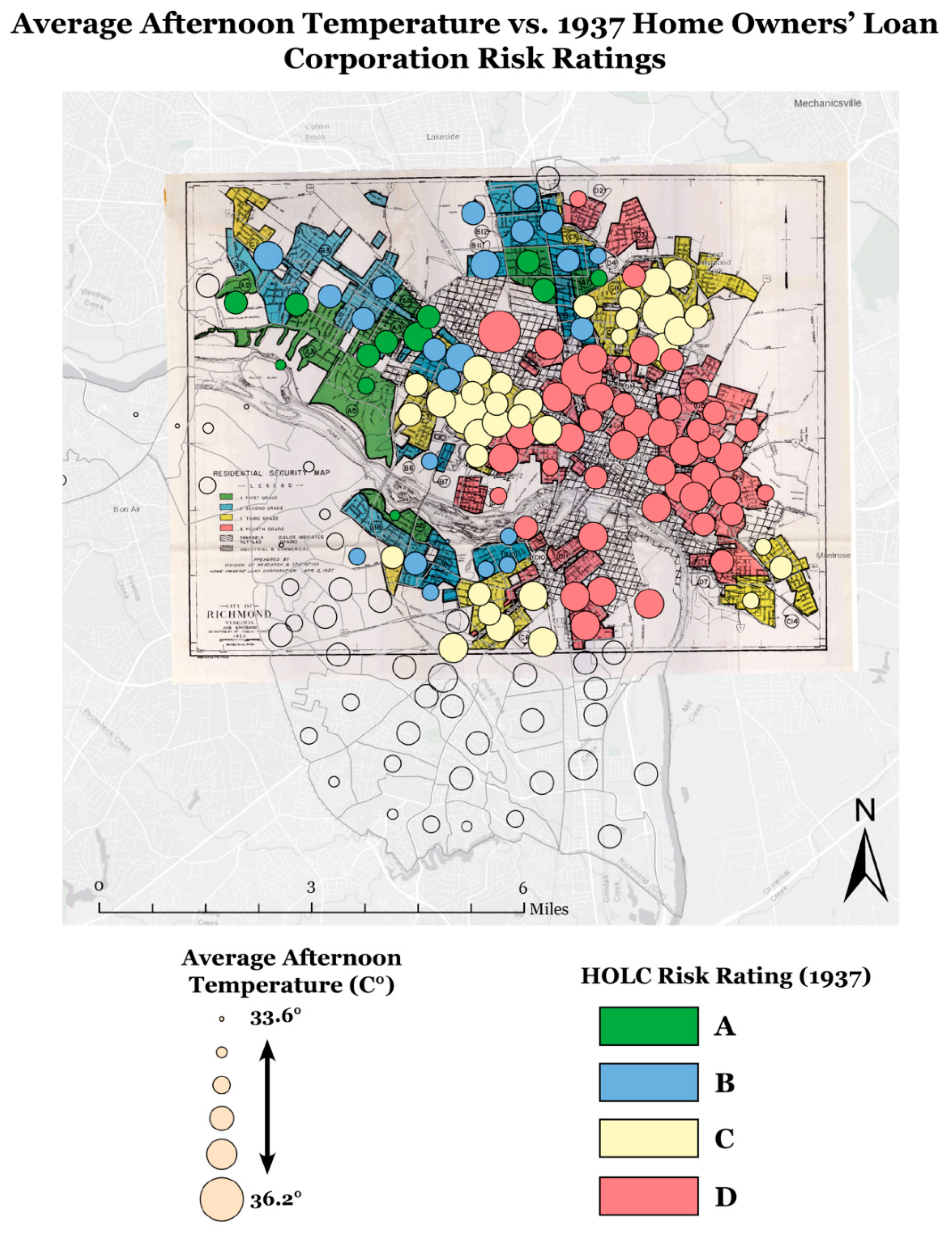

Sustainability Free Full Text Thermal Inequity In Richmond Va The Effect Of An Unjust Evolution Of The Urban Landscape On Urban Heat Islands Html

Pay Personal Property Taxes in the City of Richmond Virginia using this service.

. The 10 late payment penalty is applied December 6 th. Real Estate and Personal Property Taxes Online Payment. Calculate personal property relief.

Personal Property Registration Form An ANNUAL filing is required on all personal property items located in. Failure to receive a tax bill does not relieve. Boats trailers and airplanes are not prorated.

My office has used the same assessment methodology for at. Personal Property Taxes are billed once a year with a December 5 th due date. 350100 x 10000 35000.

In neighboring Henrico County where personal property tax rates are the lowest in the Richmond area at 350 per 100 assessed value leaders have proposed using a newly amended Virginia law that. A Guide to the Land Tax Personal Property Tax and Miscellaneous Separated Records of the Virginia Auditor of Public Accounts 1782-1856. Personal property tax bills have been mailed are available online and currently are due June 5 2022.

The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons. 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am. If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed value.

Table of Contents Title 581. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. 295 with a minimum of 100.

The tax rate is 1 percent charged to. Personal Property taxes are billed annually with a due date of December 5 th. The personal property tax is calculated by multiplying the assessed value by the tax rate.

Thoroughly determine your actual property tax applying any exemptions that you are allowed to have. Personal Property Taxes. At this stage you better solicit for help from one of the best property tax attorneys in Richmond VA.

The Commissioner of the Revenue is responsible for the assessment of all personal property with taxable status in Virginia Beach. 226 for 2021 x 35000 7910. Personal property tax car richmond va.

Monday - Friday 8am - 5pm. Personal Property Tax. Apply the 350 tax rate.

49 for 2020 x 69480 34045. At the calculated PPTRA. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

Questions answered every 9 seconds. Offered by City of Richmond Virginia. Interest is assessed as of January 1 st at a rate of 10 per year.

Pay Personal Property Taxes. The Personal Property Taxpayers Division assesses all vehicles including cars trucks trailers motorcycles motor. Personal property taxes are billed annually with a due date of december 5 th.

Drury Plaza Hotel Richmond Richmond Va 2021 Updated Prices Deals. The County bills personal property taxes in halves. An example provided by the City of Richmond goes like this.

Warren County levies a personal property tax on automobiles trucks mobile homes pro-rated quarterly motor homes recreational vehicles boats motorcycles and trailers. The Code of Virginia Section 5813503 provides for the categories of property and the methods of assessment available to commissioners. COVID-19 IMPACT TO VEHICLE VALUES FOR 2022.

Example Calculation for a Personal Use Vehicle Valued at 20000 or Less. Personal property taxes in Warren County are assessed by the Commissioner of the Revenue and collected by the Treasurer. The Commissioner of the Revenue is responsible for assessing personal property taxes VA Code Sec 581-3100-31231.

Taxpayers can either pay online by visiting RVAgov or mail their payments. If your vehicle is valued at 18030 the total tax would be 667. The governing body of any county city or town may provide by ordinance for the levy and collection of personal property tax on motor vehicles trailers semitrailers and boats.

Questions answered every 9 seconds. Sales Tax State Local Sales Tax on Food. Personal property tax car richmond va.

Richmond City has one of the highest median property taxes in the United States and is. The personal property tax is calculated by multiplying the assessed value by the tax rate. As June 5 falls on a Sunday all payments postmarked on or before June 6 will not be subject to penalties and interest for late payment.

Assessed value of the vehicle is 10000. Personal property tax car richmond va. Real property tax on median home.

The current percentage reduction for personal property tax relief is 521 for the 2021 tax year. Reduce the tax by the relief amount. Answer the following questions to determine if your vehicle qualifies for personal property tax relief.

The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts excluding the rental of vehicles licensed by the state from rental of personal property for 92 consecutive days or less. For questions regarding mobile homes please contact the Commissioner of the Revenue by phone at 804-748-1281 or via email at Commissioner of the Revenue. Is more than 50 of the vehicles annual mileage used as a business.

If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. Electronic Check ACHEFT 095. Broad Street Richmond VA 23219.

Sustainability Free Full Text Thermal Inequity In Richmond Va The Effect Of An Unjust Evolution Of The Urban Landscape On Urban Heat Islands Html

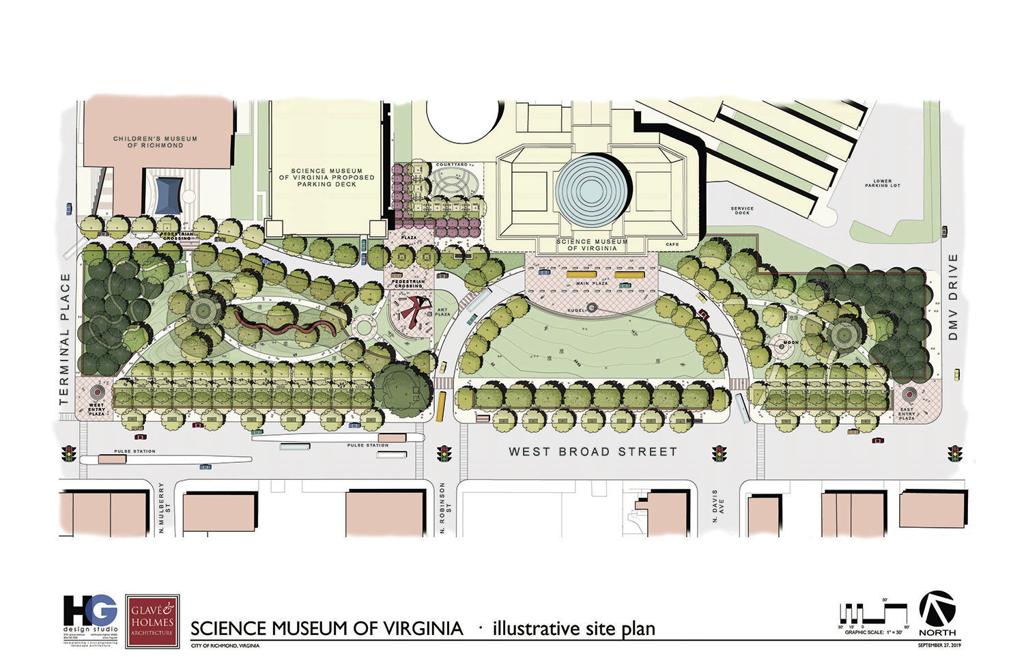

Science Museum Of Virginia New Parking Deck Now Open Old Parking Lot To Become Green Space Entertainment Richmond Com

Sustainability Free Full Text Thermal Inequity In Richmond Va The Effect Of An Unjust Evolution Of The Urban Landscape On Urban Heat Islands Html

Sustainability Free Full Text Thermal Inequity In Richmond Va The Effect Of An Unjust Evolution Of The Urban Landscape On Urban Heat Islands Html

Science Museum Of Virginia New Parking Deck Now Open Old Parking Lot To Become Green Space Entertainment Richmond Com

1604 Brookland Pkwy Richmond Va 23227 Realtor Com

2519 W Grace St Richmond Va 23220 Realtor Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/5UNUTBEIQVHQTNGQORDRDXSU5Y.jpg)

Police Investigate Report Of Shots Fired Near George Wythe Hs

News Flash Hanover County Sheriff Va Civicengage

1514 Grove Ave Richmond Va 23220 Trulia

4153 English Holly Cir Richmond Va 23294 Realtor Com

Used 1982 Datsun 280zx 2dr Hatchback For Sale In Richmond Va Jn1hz04s9cx430015

1613 W Cary St Richmond Va 23220 Realtor Com

Personal Property Tax Assessments Howstuffworks

Sustainability Free Full Text Thermal Inequity In Richmond Va The Effect Of An Unjust Evolution Of The Urban Landscape On Urban Heat Islands Html

.png)

.png)